The Elliott Wave Principle is a form of technical analysis that traders use to analyze financial market cycles and forecast future market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective activities. Developed by Ralph Nelson Elliott in the 1930s, this theory posits that market prices unfold in specific patterns or waves, which are repetitive in nature but not necessarily in terms of time.

Key Concepts of the Elliott Wave Principle

- Wave Structure:

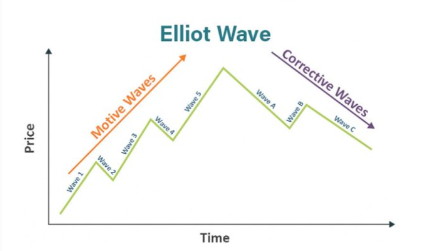

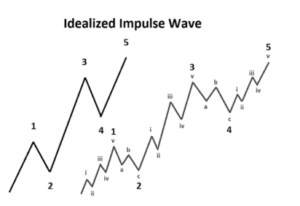

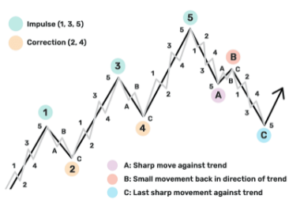

– Impulse Waves: These are the primary waves that move in the direction of the larger trend. An impulse wave consists of five sub-waves: three motive waves (1, 3, and 5) and two corrective waves (2 and 4).

– Corrective Waves: These waves move against the direction of the larger trend and consist of three sub-waves: two motive waves (A and C) and one corrective wave (B).

Wave Patterns:

– 5-3 Formation: The basic Elliott Wave pattern consists of a five-wave advance followed by a three-wave correction. In a bullish market, waves 1, 3, and 5 are upward movements, and waves 2 and 4 are corrections. The three-wave correction is labeled A, B, and C.

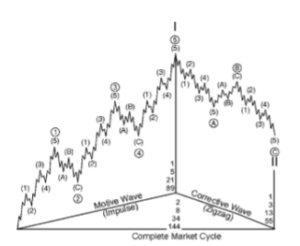

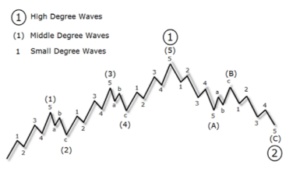

- Wave Degrees:Elliott identified nine degrees of waves, ranging from the smallest (Subminuette) to the largest (Grand Supercycle). Each wave degree nests within the larger wave degree, forming a fractal pattern.

- Rules and Guidelines:

– Rule of Alternation: In a five-wave impulse, wave 2 and wave 4 will alternate in their form (e.g., if wave 2 is a sharp correction, wave 4 will be a flat correction, and vice versa).

– Wave 2 Never Retraces Beyond the Start of Wave 1: The low of wave 2 must be above the start of wave 1 in an upward trend.

– Wave 3 Cannot Be the Shortest: Among waves 1, 3, and 5, wave 3 is usually the longest and can never be the shortest.

– Wave 4 Does Not Enter the Price Territory of Wave 1: In an upward trend, the low of wave 4 must be above the high of wave 1.

Application of Elliott Wave Principle

- Identifying Wave Patterns:Traders first identify potential wave patterns on price charts. This involves recognizing the impulse and corrective waves within the price movement.

- Forecasting Market Trends:By identifying the current wave position, traders can forecast future market trends. For example, if a trader identifies that the market is in wave 4 of a bullish trend, they can anticipate the upcoming wave 5, which is expected to be an upward movement.

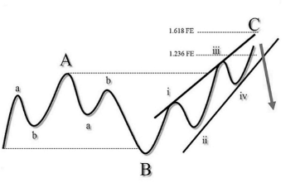

- Using Fibonacci Ratios:Elliott Wave practitioners often use Fibonacci retracement and extension levels to predict the potential length of waves. For example:

– Wave 2 typically retraces 50%, 61.8%, or 76.4% of wave 1.

– Wave 3 is often 161.8% of wave 1.

– Wave 4 typically retraces 23.6% or 38.2% of wave 3.

– Wave 5 is often 61.8% or 100% of wave 1.

Motive & Corrective Wave: In Elliott Wave Theory, market movements are classified into two main types of waves: motive waves and corrective waves. These waves form the basic building blocks of the Elliott Wave Principle and help traders understand the structure of market trends and corrections.

Motive Or Impulse: Waves (1), (2), (3), (4) and (5) together complete a larger impulsive sequence, labelled wave [1]. The impulsive structure of wave [1] tells us that the movement at the next larger degree of trend is also upward. It also warns us to expect a three-wave correction in this case, a downtrend. That correction, wave [2], is then followed by waves [3], [4] and [5] to complete an impulsive sequence of the next larger degree, labelled as wave one. At that point, again, a three-wave correction of the same degree occurs, labelled as wave two. Within a corrective wave, subwaves A and C are usually smaller- degree impulsive waves. This means they too move in the same direction as the next larger trend. Note that because they are impulsive, they themselves are made up of five subwaves. Waves labelled with a B, however, are corrective waves; they move in opposition to the trend of the next larger degree. These corrective waves are themselves made up of three subwaves.

Wave 1 must be an impulse or a leading diagonal

Wave 2 can be any corrective pattern except a triangle and must not retrace more than 100% of wave 1

Wave 3 must be an Impulse and must be longer than wave 2 and wave 3 should never be the shortest wave when compared to waves 1 and 5

Wave 4 can be any corrective pattern (zig-zag, double or triple zig-zag, triangle, flat, double or triple three) and wave 4 should never trade into a territory of wave 1

Wave 5 must be an impulse or an ending diagonal

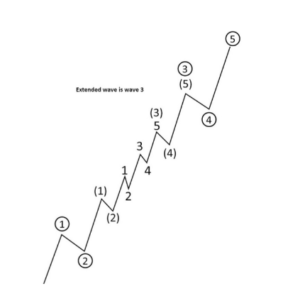

Extended Wave 3: Most impulses contain what Elliott called an extension. An extension is an elongated impulse with exaggerated subdivisions. The vast majority of impulses contain an extension in one and only one of their three actionary subwaves. The fact that extension typically occurs in only one actionary subwave provides a useful guide to the expected lengths of upcoming waves. For instance, if the first and third waves are about equal length, the fifth wave will likely be a protracted surge. Conversely, if wave three extends, the fifth should be simply constructed and resemble wave one. In the market, the most commonly extended wave is wave 3.

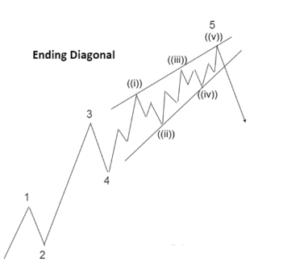

DIAGONAL TRIANGLE (Ending Diagonal): A Diagonal is a common 5-wave motive pattern labelled 1-2-3-4-5 that moves with the larger trend. Diagonals move within two contracting channel lines drawn from waves 1 to 3, and from waves 2 to 4. There are two types of diagonals: leading diagonals and ending diagonals. They have a different internal structure and are seen in different positions within the larger degree pattern. Ending diagonals are much more common than leading diagonals. An ending diagonal is a special type of pattern that occurs at times when the preceding move has gone too far too fast, as Elliott put it. A very small percentage of ending diagonals appear in the C wave position of A-B- C formations. In double or triple threes, they appear only as the final “C” wave. In all cases, they are found at the termination points of larger patterns, indicating exhaustion of the larger movement.

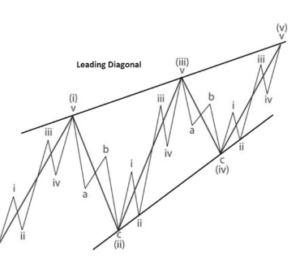

DIAGONAL TRIANGLE (Leading Diagonal): When diagonal triangles occur in the fifth or C wave position, they take the 3-3-3-3-3 shape that Elliott described. However, it has recently come to light that a variation on this pattern occasionally appears in the first wave position of impulses and in the A wave position of zigzags. The characteristic overlapping of waves one and four and the convergence of boundary lines into a wedge shape remain as in the ending diagonal triangle. However, the subdivisions are different, tracing out a 5-3-5-3-5 pattern.

Zig-Zag: A Zig-Zag is a 3-wave structure labeled A-B-C, generally moving counter to the larger trend. It is one of the most common corrective Elliott patterns. Corrective patterns are labeled with letters, and move against the larger trend Structure is 5-3-5. Wave A must be a motive wave. Wave B can only be a corrective pattern. Wave B must be shorter than wave A by price distance. Wave C must be a motive wave. It appears in Wave 2 or 4 in an impulse, Wave B in an A-B-C, Wave X in a double or triple Zig- Zag, or Wave Y in a triple three

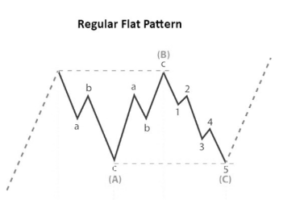

Flat (Regular, Expanded & Running): A Flat is a three-wave pattern labeled A-B-C that generally moves sideways. It is corrective, counter- trend and is a very common Elliott pattern. Structure is 3-3-5. Wave B terminates about at the level of the beginning of wave A. Wave C terminates a slight bit past the end of wave A. It appears in wave two or four in an impulse, wave B in an A-B-C, wave X in a double or triple zig-zag, or wave Y in a triple threes

Expanded Flat: Structure is 3-3-5. Wave B terminates well beyond the beginning of wave A as in an expanded flat. Wave C fails to travel its full distance, falling short of the level at which wave A ended. It appears in wave two or four in an impulse, wave B in an A-B-C, wave X in a double or triple zig-zag, or wave Y in a triple threes